The quarter’s performance was strongly impacted by November, one of the stronger months of the year, that was surrounded by two weak months (October and December). November’s gains exemplified the great demand for incremental yield amid a context in which there was little, if any, discernment regarding credit risk.

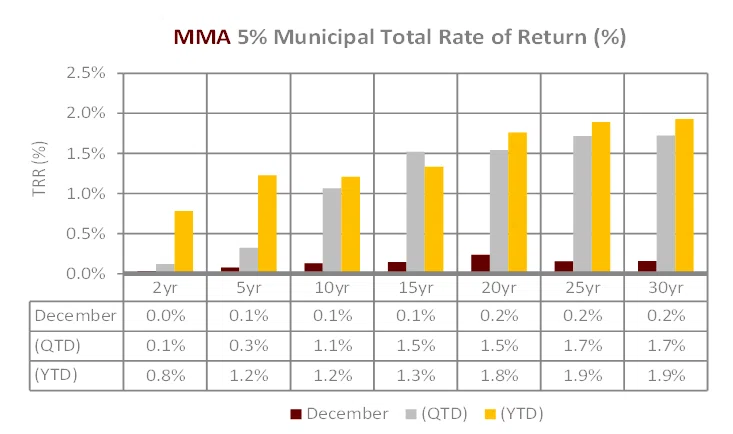

December’s large number of unchanged trading sessions extended the year’s total unchanged days to 113, a record. In addition, in 2021, there were 190 trading days during which the municipal market posted a daily price change between +/- 0.13%. Below are MMA’s Total Rate of Return Indexes for December, 4th Quarter, and 2021.

OCTOBER

OCTOBER

The MMA municipal price index maintained a negative price trend for nearly all of October, before turning positive at month-end. The Index posted a loss of ~ -0.50%, consistent with the negative seasonal bias since 1990; and the benchmark 10-year index rose 7 bps. October represented the 3rd month of higher yields, resulting in both MMA’s deviation index falling to its lowest level since February, and benchmark yields reaching the levels of 1Q21 (MMA benchmark 10-year rose above 1.40%). The return to the higher yields of late February and early March drew SMA, bank and P&C interest that contributed to retail and institutional trading volume rising respectively ~20% and ~12%, MoM. Inconsistent with history was the equivalence of October’s issuance compared to September. On average since 1988, October supply had been 28% greater than the prior month. The month’s issuance was also -17% below the month’s prior decade average. Secondary breaks were mixed, but the largest breaks were reflective of cautious underwriting amid the market’s greatest uncertainty during the month (BAML maintained its underwriting lead of large deals, > $100M), capturing respectively 34% and 35% of the total number of issues and par). The CA community college deal and Miami-Dade FL Health issue both rallied 10+ bps more than the market in the secondary. However, even though issuance was light, municipal bond funds experienced tepid inflows that produced 5 straight weeks below $1B for the first time since 2Q20. The decline in inflows increased distribution challenges and coincided with the rise in secondary supply measures. Bids-wanted par daily average rose above $700M in October, while offering par’s daily average reached its highest level of the year. The municipal curve, 2 to 10-years, steepened a mere 1 bp to a slope of 114 bps; but the longer maturities showed a slight flattening that was influenced by the dramatic movement of the US Treasury curve and the inversion of its 20 and 30-year maturities. The distinctive yield movement of the two markets added volatility to ratios in October. Even though ratios were similar at both September and October’s ends, the 5 and 10-year maturities moved ~5 ratios lower and then ~5 ratios higher.

NOVEMBER

NOVEMBER

MMA’s municipal price index started the month in a positive condition that was maintained with only a minor pause. As a result, the index posted a gain in excess of 1% for the month, and at month-end the constructive trend returned ahead of the seasonally positive December. The fundamental ambiguity was pronounced in February as concerns heightened regarding Biden’s economic agenda, inflation, FOMC tapering, emergence of the Omicron virus and US equities at record highs. Treasury volatility was the highest since February, contributed to a number of explosive sessions and increased ratio volatility. Treasuries’ positive days represented opportunities for municipal investors to create positive price discovery for evaluations to enhance returns. Seven sessions starting on November 3 represented 82% of municipals’ monthly gains. These same sessions enabled issuers to derive low costs of capital and generated most of municipal funds’ monthly returns in the first two weeks of the month. Tax-exempts positive bias was further enhanced by a return of strong weekly fund inflows which were skewed toward long maturing and high-yield bonds. The interest in long-term debt flattened the 2 to 30-year slope and enhanced the gains of lower coupon structures. Investors who were rebalancing portfolios, as equities attained records, focused on the incremental yield and the perceived stalwart credit conditions of the municipal market. The demand enhanced opportunity for issuers who sought capital access. November only reemphasized the attractiveness of the municipal market as evidenced by the persistent issuance of “risky” sector deals. The receptiveness to lower rated issues was emboldened by MMA’s mid-year credit review that identified only 3 sectors of 2H weakness and positive outlooks for all safe sectors. However, long-term risks remained, i.e. climate, but they were discounted in light of the immediate business need to invest available capital. Credit spreads did tighten in November, but were still not as narrow as in August or February 2020. Also, lower rated issues continued to provide investor opportunity as their strong secondary breaks enhanced returns. Overall, November issuance was slightly less than October, but higher than the month’s prior decade average.

DECEMBER

DECEMBER

December’s characteristics were reflective of the municipal market for the year. An intense focus on the limited number of large primary issues, combined with steady demand, provided little impetus for secondary activity and market change. MMA data reflected only one day of price change for the entire month. In December 2020, the last two weeks of the year similarly posted no price change. For 2021, municipals posted a record 113 trading days where prices were unchanged, breaking the 2020 prior record of 71. The dramatic increase compared to history might be symptomatic of the steady fund inflows, consistent bank demand and persistent interest from wealth platforms since November 2018. The municipal market’s uniform demand component and indexed portfolio structures combined with the perceived absence of credit risk added further to limited differences in daily market activity. The annual daily municipal price change still reflected a normal distribution, but also the number of days between +/- 0.13% reached a high of 190. This too contributed to the reduced opportunities for profitable trading in the secondary and liquidity. Performance opportunities were more concentrated in the strong secondary breaks of lower rated issues. Strong breaks combined with perceived limited near-term credit risk contributed to high-yield’s leading returns. High-yield TRR indexes revealed that intermediate structures performed similarly or better than long high-yield indexes. In contrast, investment-grade indexes posted their best returns in longer maturities. The consistent large inflows into long funds dampened the steepening of the municipal curve in 4Q, and the dismissal of credit risk stabilized spreads, that remained tighter than their 5-year average. Where there was evident volatility and increased trading activity was during the year’s periods of distress, when higher yields coincided with higher institutional and retail trading activity. February and October’s peak yields encouraged more transactions.

PREVIOUS

NEXT

All content Copyright 2022 Fixed Income Insights. All rights reserved.