PREVIOUS

NEXT

Follow Us

All content Copyright 2023 Fixed Income Insights. All rights reserved.

Market Structure & Trends

BondWave QMarks™ Quarterly Dashboards Q3 2023

Scroll down

Developed to help market participants better understand trading trends in the bond markets, BondWave’s Data Lab has released its QMarks™ dashboards for the third quarter of 2023.

QMarks is a proprietary BondWave data set that powers its quarterly dashboards to cover all disseminated bond transactions using the regulatory-prescribed Prevailing Market Price methodology for corporate, municipal, agency, and 144A. QMarks belongs to a suite of other BondWave proprietary data sets, including QCurves, QTrades, and QScores.

Q3 2023 Observations:

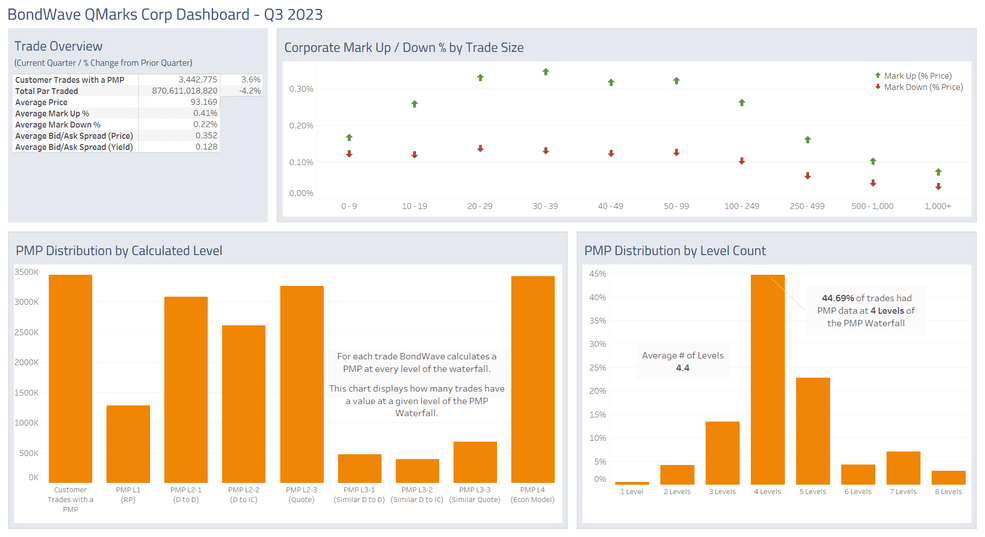

Corporate Bond Market Trends

- Corporate bond par traded in Q3 shrunk while trade volume grew as the average trade size shrank.

- With par traded 4.2% below the prior quarter and the number of trades 3.6% greater than the prior quarter, average trade size shrunk from $273,643 in Q2 to $252,881 in Q3.

- Mark-ups and mark-downs held steady in the quarter while the average bid/ask spread came in by 8.7 basis points to 35.2 basis points.

Source: BondWave QMarks

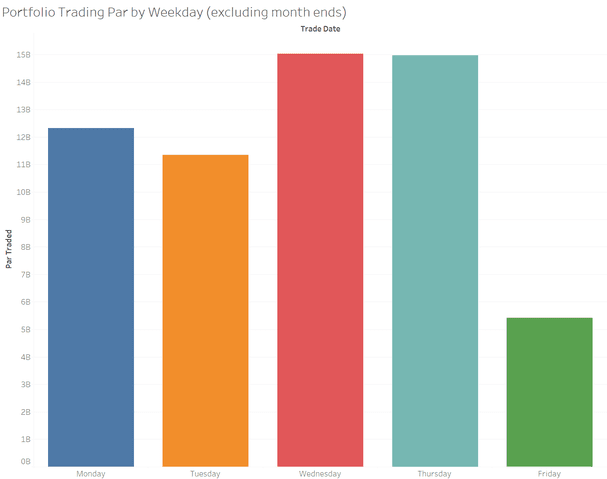

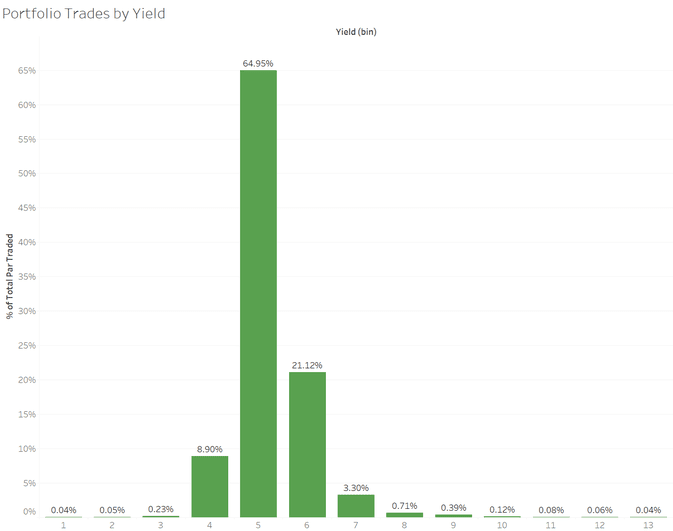

- The decrease in average trade size may be due to the fact that corporate bond portfolio trading has been on the upswing.

- Starting with this quarter, BondWave will begin to include statistical summaries of portfolio trading for corporate bonds.

Source: BondWave QMarks

- The most popular days to execute portfolio trades in Q3 were Wednesday and Thursday. Clearly, no one wants to stay late on a Friday to process portfolio trades.

Source: BondWave QMarks

- 98.27% of bonds in portfolio trades have reported yields between 4% and 8%.

Municipal Bond Market Trends

- Most measures of municipal trading remained steady over the quarter (mark-ups, bid/ask spread) along with the trade volume.

- There are 11% more municipal bond trades with a Prevailing Market Price in Q3 than there were in Q2. However, the percentage of trades which have a value at a given level of the PMP Waterfall remains relatively unaffected.

Source: BondWave QMarks

Agency Bond Market Trends

- Agency bond trade counts saw a healthy 17.6% increase in Q3 to go with a modest 1.5% increase in par traded.

- The result is that the average trade size shrunk from $314,451 in Q2 to $271,681 in Q3.

- Trade costs (mark-up, mark-down, bid/ask spread) were virtually unchanged during the quarter.

Source: BondWave QMarks

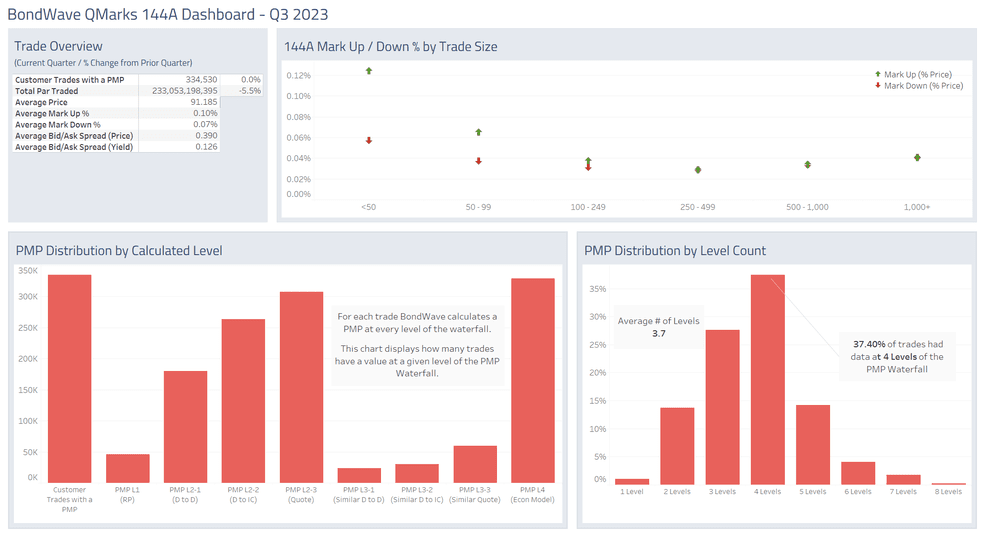

144A Bond Market Trends

- 144A bond trading in Q3 followed an identical pattern to their registered counterparts.

- Par traded shrank as did average trade size relative to Q2.

- Mark-ups and mark-downs held steady in the quarter while the average bid/ask spread came in by 3.7 basis points to 39 basis points.

Source: BondWave QMarks

Dashboards for the previous quarter referenced above are located here: Q2 2023 Dashboards

About BondWave LLC

Founded in 2001, BondWave, an affiliate of First Trust Portfolios, is a financial technology firm specializing in fixed income solutions. We serve a wide range of users including traders, compliance professionals, and RIAs from the smallest to the largest firms in the industry who use our tools to provide a superior fixed income experience to their clients while supporting critical regulatory mandates.

Effi®, our Engine for Fixed Income, is the single platform through which we deliver all our solutions providing intuitive dashboards and insights into every fixed income position and transaction. Capabilities include portfolio analytics and reporting, custom alerts, and proposal generation, as well as tools that support best execution, fair pricing, and mark-up monitoring and disclosure on both a pre- and post-trade basis. BondWave leverages advanced technologies and data science to develop proprietary data sets that fuel our innovative solutions.

To learn more, please visit bondwave.com, email info@bondwave.com, or call 877.795.2929.