PREVIOUS

NEXT

All content Copyright 2023 Fixed Income Insights. All rights reserved.

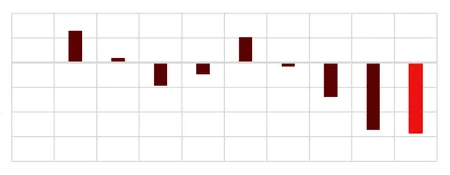

Municipal bonds posted significant losses in the third quarter of 2023, as MMA’s 11-15yr price index reflected a cumulative loss of nearly -6.5%. Large August and September declines essentially erased the positive YTD investment-grade returns across index maturities, except the 1-2yr. Municipal HY faired better, but still has suffered losses further out the curve. Through Q3, the number of extreme price loss days, of -0.25% or more, rose above the annual average (26 day vs. annual avg. of 22). Throughout the quarter, the focus remained on the Fed’s inflation fight and there was increased speculation that they will hold rates higher for longer. FOMC meetings, CPI data, and jobs reports were focal points for clues on how the Fed will handle monetary policy going forward.

The percent of active fund managers that beat their benchmarks was down to 49% in Q3, from 62% in Q2; reflecting the growth in net fund outflows in Q3, but also the greater amount of selling that was forced into a downward trending market. However, many more funds have outperformed their benchmarks this year vs. last. Measures of secondary supply (i.e. bids wanted and offerings) rose throughout the quarter, with some measures of municipal offering par setting new record highs, reflecting still narrow demand and inefficient primary and secondary distribution. Primary supply was actually slightly above the prior decade average in August, but below averages in July and September, so that 16 of the last 17 months experienced below average issuance.

There remained increased recognition of climate risks throughout Q3 (in part due to the tragic HI wildfires). The evolving theme, in addition to rising rates and a looming economic recession, contributed to the increased use of bond insurance, now >8.0% of total primary market par. The accelerating reallocation of climate risks, from P&Cs to governments to bondholders, has improved the use case for monoline insurance. MMA assumes that, as investors become better aware of P&C actions to offload related exposure, their incentive to manage down portfolio credit risks will rise.

JULY

The start of the year’s 2H has often been accompanied by a favorable supply/demand imbalance that has contributed to a positive market through Labor Day. While municipal performance was positive in July, it was muted, and led by high-yield. MMA’s high-grade price index gained 0.30% during the month, so that total rate of return indices showed returns in excess of 0.50% from 10yrs and longer. Municipal price volatility increased in July vs. June, and finished slightly above the month’s historical average. The increase was attributed to just 11 of July’s sessions finishing unchanged, vs. an average of 14 sessions in a month. Investors, as they did in June, continued to extend out the yield curve and down the ratings scale to generate greater income for clients – particularly more aggressive SMAs. Returns were essentially unchanged at mid-month, until the better-than-expected core CPI report rallied Treasuries and shifted municipal price momentum positively on July 13. Price momentum remained positive through the July 26 FOMC decision, after which the Treasury 10yr ascended back >4.0% for the first time since November 2022. MMA’s municipal price index turned negative on July 27 and lost -0.40% through month-end. The negative trend was thought to challenge August’s positive seasonal bias. Most economists expected July’s FOMC rate increase to be the last of the hiking cycle, and inquiries to MMA grew more frequent regarding the timing of appropriate duration extension. In other words, when to forgo short-term Treasuries and invest client capital into longer fixed income funds, including municipals. In July, issuance was again less than seasonal expectations, and contributed to tax-exempts’ outperformance vs. Treasuries and US IG corporates. Institutional volumes fell sharply in July, while retail declined modestly after three consecutive months of gains. Credit headlines were muted as defaults remained lower than the historical monthly pace, but impairments persisted to grow quickly, raising future credit concerns. Climate issues gained greater attention, though municipal ratings and evaluations reflected little adverse impact. Demand remained driven by SMAs as mutual fund and ETF participation was stunted by minimal flows.

AUGUST

MMA’s price index established a negative trend on July 27 and maintained the weak bias for most of August. For only the 4th time in 10 years, the MMA 10yr yield penetrated 3.0% to reflect initial value; a level that 1) has only been sustained for brief periods over the last decade, and 2) has prompted greater retail demand. Retail has a long history of chasing yields higher, while institutions have typically increased demand when the need to access product and invest new cash has been high (i.e., mutual fund inflows). As yields increased and funds remained absent in August, retail activity climbed while institutions stabilized, reflecting the year’s still-heavy dependence on SMA demand. Nonetheless, MMA’s bellwether 11-15yr index posted a price decline of -2.52% in August, the month’s third worst performance since 1990. The negative bias waned at mid-month, but reemerged following Treasury pressure related to rising expectations that the US would avert a recession, and also dial-backed bets the Federal Reserve will pivot to an easier policy. August challenged the underwriting process amid a lack of positive momentum. Primary issuance began to normalize, finishing close to the month’s average. High-yield (HY) indices mostly outperformed investment-grade (IG), although both remained under pressure throughout the month. SIFMA 7-day was reset to 4.47%, then back to 4.06% at month-end. The 4.47% level was the highest since March 2020, and ~50 bps above the 30yr high-grade offered-side yield: a difficult context in which to extend duration, despite the historical outperformance of long-duration funds in the 12 months following a tightening cycle’s final hike. The HI wildfires and legal impacts for Hawaiian Electric added to the headlines of the summer that amplified awareness of climate risks. The HI event was preceded by adequate disclosure related to its physical risks, but was followed by ratings downgrades and sharp security declines. As such, the question of whether ratings and evaluation services should shift from reflecting current conditions to becoming more proactive in assessing future risks was raised. Extreme heat and drought persisted under the “heat dome” in the US Southwest, while hurricane Idalia strengthened to a category 3 before hitting FL’s coast. Groundwater concerns also rose in the mid-west, with wells depleted and aquifers compromised. August’s block trading reflected slight underperformance of issuers exposed to greater flooding and wildfires, yet investors had yet to seek meaningful concessions for issuers with significant climate risks. The month’s events served as a catalyst to emphasize the importance, but also the opportunities of adaptation projects financed by the municipal industry. The era of “adaptation finance” could grow annual municipal issuance significantly (> $600B), as the number of US billion dollar disasters related to climate change was on track to 4x the number that occurred in 2002.

SEPTEMBER

The municipal market initially attempted to heal following a difficult August, but ultimately collapsed in September and posted a price loss of -3.70%. Municipal price volatility surged above average, while record-high secondary selling pressure without mutual fund inflows or reinvestment demand inhibited the efficient placement of bonds, even as primary issuance remained low. September supply totaled $27.5B, -12% below the month’s average. The unfavorable seasonal context, more concentrated liquidity, Treasury weakness and absence of a positive price trend all coincided with narrow distribution and a tentative secondary bid at mid-month, which evolved into extreme adversity into month-end. High-yield (HY) indices outperformed investment-grade (IG) in September. 10yr taxable equivalent yields between 5.0—6.0% during the month served as a constant reminder of the prevailing income opportunities. Recall, too, yield levels were similarly high in October 2022, before a forceful retail bid produced the strongest November return on record. However, investors in September were content in shorter-term products – MMFs, CDs and T-bills – so the push for duration waned simply because of high yielding “cash”. Price volatility remained extremely high in September; municipals suffered their 2nd, 3rd and 4th worst sessions of the year during the month. YTD there had been 26 days of extreme price loss—the average for a full year since 2010 had been 22 days. A record high 77% of tax-exempt primary market par was priced with a 5% coupon in 3Q23, up from 73% in 2Q23 and 35% in 1Q22. So even though tax-exempt yields >3.0% with coupons at 5% remained important for retail distribution, the record level of secondary offerings still were a reminder of the difficulty in placing bonds regardless of higher yields and better rate protection. Finally, even though the negative price trend is in place, the two consecutive months of weakness has created both absolute (extremely oversold as measured by MMA’s deviation Index) and relative value (ratio standard deviations grossly positive) as occurred in 4Q22.