Municipal Markets

BY Tom Doe, Municipal Market Analytics

The Muni Market in Review: 1Q 2022 - Municipal Market Analytics

The Muni Market in Review: 1Q 2022 - Municipal Market Analytics

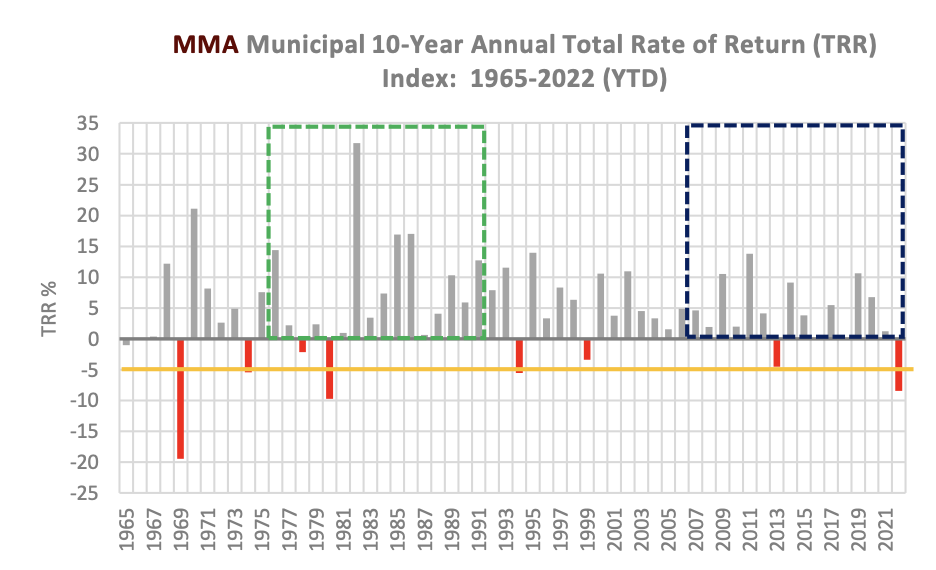

The MMA 10-year total rate of return index extends back to 1965, during which time the index, on an annual basis, experienced its worst year in 1969, and its second worst returns in 1980. In 2022, YTD, the index has lost > -8%; were the year to end at 1Q, it would represent the 3rd worst performance in more than 50 years. It has been exceedingly rare for the index to have a negative annual return (see below). Also, in the chart below, the green box represents the first 14 years of municipal bond funds’ existence, and the blue box identifies the first 14 years of municipal ETFs. Both products have attained similar AUM totals in their initial years of development despite quite different market contexts and how the products were and have been marketed by investment firms to individual investors.

The distribution of municipals’ daily price change has captured 2022’s adversity. YTD, there have been twenty-five sessions when municipals have experienced a -0.25% or greater price decline—a total that has exceeded the average for the years 2010 to 2021. Mutual fund outflows persisted throughout the quarter (> $27.5B in 1Q). Outflows were from long and high-yield funds and inflows were into short-term funds. Inflation concerns and speculation of more aggressive rate hikes drove yields higher. On March 16, the Federal Reserve raised rates by 0.25% and signaled more hikes to come. Municipals incurred a price loss of -4.5% in March, slightly less than what was attained in March 2020.

JANUARY

January represented a historic loss for the month. MMA’s municipal price index posted a decline of -5%. While the magnitude of the loss was significant, more so was the speed of the decline. As a result, MMA’s Deviation Index, a measure of technical overbought and oversold conditions, breached the -3% threshold and fell to -5.5%, a level rarely reached, which quantified the severity of market conditions but suggested that opportunity might emerge in the weeks ahead. Many days of consecutive large price losses to end January’s last week represented a characteristic trait of adverse periods since 2008. What was lacking in a comparison to more recent negative periods was a “tipping point” credit event that would unnerve individual investors. Prior to 2020, it was PR in 2013 and S&P’s tobacco downgrades in 2010. In January 2022, mutual funds and ETFs displayed uniform weak performance, as intermediate investment-grade funds suffered, and secondary selling focused on the short and middle areas of the curve to attain liquidity. This specific attention resulted in curve flattening, and an underperformance of 5% coupons. Credit spreads did widen in longer maturities reflective of the coupon differential in the longer maturities between GO and revenues. The eclectic municipal coupon structure persisted (as it would all quarter) as an important consideration to municipal participants. January’s weakness occurred amid light primary issuance, which included the lowest monthly taxable total ($2B) since at least July 2020. Secondary measures rose because of net outflows from mutual funds and ETFs. Bids-wanted par daily average was greater than $800M during the month, while offering par’s 5-day average increased above $16B, a data point comparable to March 2020. The large secondary flows, as well as the higher yields, did drive trading levels above the historical averages in the month’s second half. Fundamentally, the attention was on inflation which was influenced by oil’s record 17% rise and natural gas’ 34% increase. The energy measures pushed the broader Commodity Research Bureau (CRB) inflation index to a figure that has often been attained when the Treasury 10-year yield was 100 bps higher.

FEBRUARY

After 6-weeks of uninterrupted price declines, the municipal market finally found some stability at month-end. MMA’s municipal price index which turned negative on January 4, returned to a positive condition on February 25. During the extended price losses, municipal yields rose sharply to curtail primary issuance. 2022’s ~$50B in YTD issuance prompted concerns that total supply could fall below $400B, well below the Street’s projections of $475B. The reduction of primary sales resulted in greater secondary activity. Municipal secondary trading surged to the highest totals in ~2 years, and offering par, after peaking at mid-month, fell ~30% by month-end. Secondary transactions increased as municipal bonds moved from mutual funds (outflows) to SMAs as investors sought the perceived stability of individual bond ownership. Short-term ETFs also gained AUM, led by JPMs short-term ETF’s increase of 34% in February. Also at mid-month, MMA’s municipal deviation index became further oversold (a condition reached at January’s end) to reach an extreme (-6%) only attained on four prior occasions since and including 2010. After each extreme, municipal prices tended to stabilize or recover, especially when MMA’s price trend eventually turned positive. The market’s emerging constructive tone was evident among municipal bond funds whose NAVs stabilized despite net outflows. At mid-month, coinciding with the oversold conditions on February 14-16, fund NAVs began to recover, albeit cautiously, amid the plethora of fundamental concerns: inflation, FOMC, US equity/rate volatility and Ukraine/Russia conflict. Municipals’ weakness during the month did create relative value to US Treasuries and global sovereign debt, while the sector’s credit stability contrasted the larger losses of US taxable debt (mortgage and corporate). Municipal credit spreads did widen slightly during February, so that bellwether relationships returned to their historical averages. The municipal yield curve (2 to 10-years) also flattened further to 90 bps to stifle the steepening trend that had suggested a slope of 150 bps or more. Throughout the month more media and regulation attention focused on climate risk and disclosure. EY’s survey of bank credit risk officers and boards placed climate as THE risk of the next 5 years. Elsewhere, global policy-makers began to abandon hope of a carbon neutral global agreement.

MARCH

In March, MMA municipal price index incurred a decline of -4.5%, slightly less than its -4.9% fall in January. The large, consistent, and rapid decline drove the MMA municipal deviation index (a measure of overbought/oversold conditions) to a level below -7%, a barrier that has only been penetrated on 3 other occasions since 2010 — 2013, 2016 and 2020. Price volatility has quickly surged amid adversity in the municipal market since the Great Recession in 2008 because of the reduced capital to maintain an orderly secondary market. Mutual fund outflows persisted throughout the month (> $27.5B in 1Q) and once again outflows were from long and high-yield funds. Fund inflows did occur into short-term funds. This dynamic was also evident in municipal ETFs, as JPM’s short-term ETF AUM grew 17% in March (13% of its AUM is an investment in JPM’s Institutional T-E MMF). 1Q’s large price decline contributed to MMA’s 10-year total rate of return (TRR) index posting a loss in excess of -8%. A slight positive associated with the higher yields was the increase in trading activity. MMA’s 10-year above 2%, a level sustained between 2015 and 2018, has coincided with the number institutional block trades rising above their daily average since 2009, 1,500 trades. The higher levels and market discord had become a boon to bond insurers, who in March, were able to wrap a significant percent of secondary par. Much of the opportunity for insurers was attributed to the wider credit spreads created by the decline of lower coupon issues. Lower coupons were penalized because of the adverse “de minimis” tax treatment and thus long maturities underperformed. Benchmark 5% coupon curves flattened, but given the eclectic coupon structure extent in municipals, the higher coupon curve analysis is irrelevant. Fundamentally, the negative impact of both Fed Chair Powell’s Humphrey-Hawkins testimony to Congress and the mid-month FOMC 25 bp rate hike were consistent with historical expectations. The May FOMC decision is now anticipated to result in a fifty bp rate increase.

PREVIOUS

NEXT

All content Copyright 2022 Fixed Income Insights. All rights reserved.